Would you rather talk to a human than fill out a form?

Call us and we will connect you with a consultant.

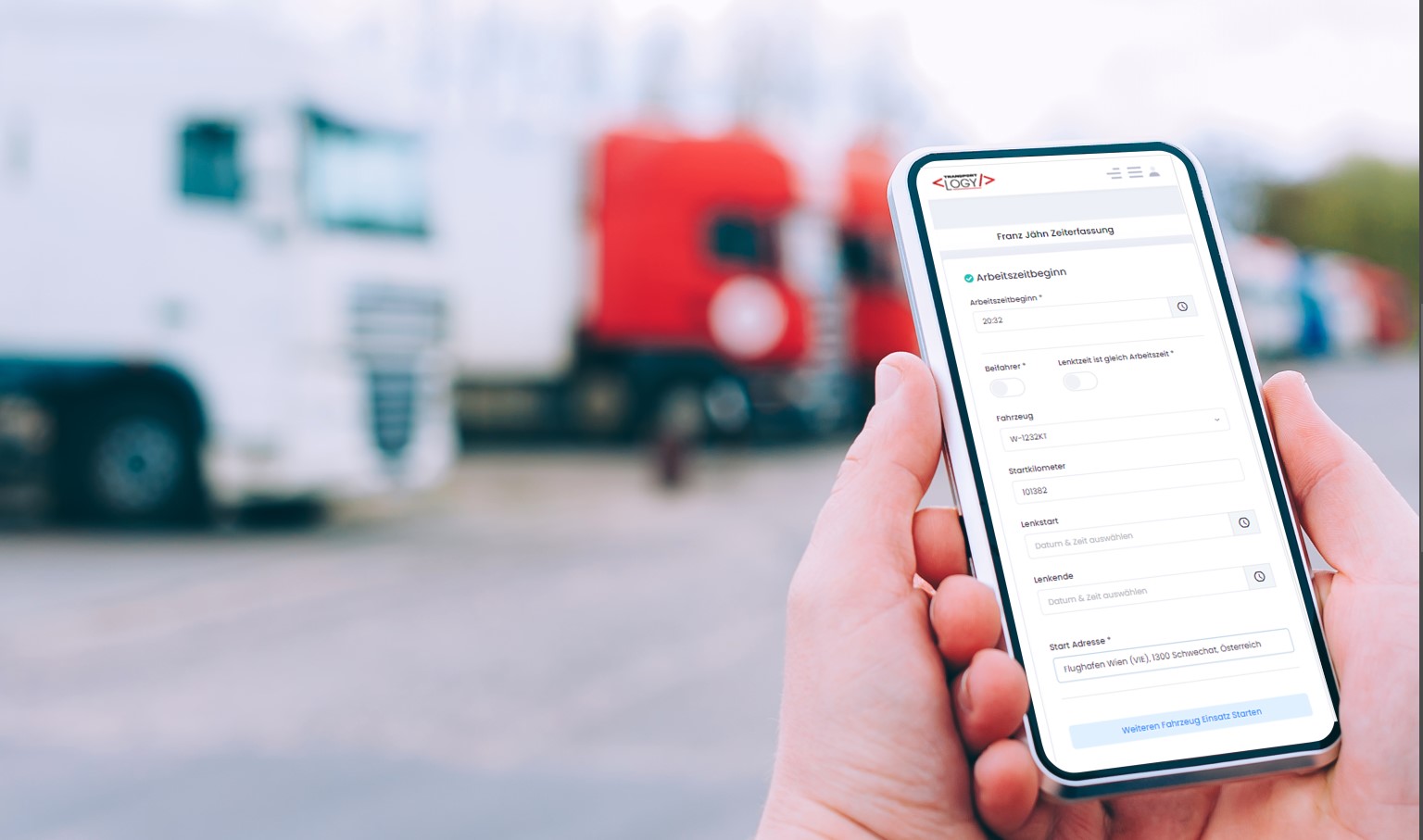

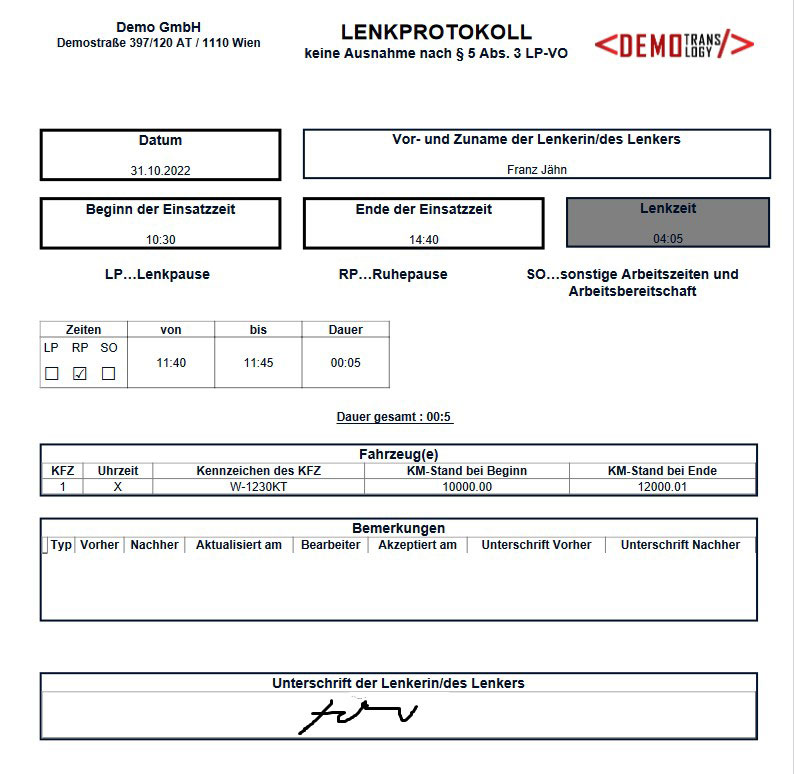

Through several discussions and consultations with the labor inspection for drivers, we have the digital driving log – with exception and driving log – no exception under § 5 para. 3 LP-VO, within the legal framework for Europe and especially Austria adapted for you Digital. No GPS device is required for the digital steering log. If desired, it can also be connected to a GPS telematics solution.

When driving motor vehicles on public roads, a driving log must be kept. This applies to all those who are not exempt from the steering log requirement or if no EU control unit is fitted. Drivers who are affected by this are usually familiar with it as a paper form that takes time and effort to fill out each time. In case of an inspection, the records of the last 28 days must be shown by the driver.

If your fleet is equipped with a GPS telematics device, we can connect it to Transportlogy. Your driver then only has to select the vehicle and the real mileage is automatically recorded. We cooperate with all known telematics providers such as:

GEOTAB

Samsara, Webfleet (TomTom), StreetWatch, Arvento, Mapon, GpsGate, and many more.

Their drivers change vehicles while on duty. In this case, this must also be recorded in the steering log. The license plate number, driving times, breaks (rest periods, driving breaks) and mileage must normally be recorded in writing in the driving log. Transportlogy frees you and your employees from tedious paperwork, as the driving log can also be recorded digitally. In just a few seconds, you have added and saved another vehicle with the data filled in.

Many companies are already trying to work sustainably. The idea is that companies can make a greater contribution to environmental protection than a single person. It’s often the little things that are easy to overlook but have a big impact. When it comes to transport & logistics companies, the first thing that comes to mind is of course the vehicle fleet, where many companies now rely on electric vehicles. But there is one thing that is just as important: not using paper. Large companies consume several tons of paper and that per year.

The electronic driving log not only saves you the expense of paper and printer cartridges, but is also sustainable.

In principle, there is no tax obligation to keep a diary! However, company car drivers must pay tax on private use and provide evidence of a proportion of their private journeys. To do this, you can keep a logbook or apply the 1% rule instead.

You don’t have to worry about whether your employees are filling out the logbook correctly. Since each driver has his own profile and starts the journey to work at the beginning of the working day or in the case of the logbook, it is enough to select the vehicle. The driving times, mileage and addresses are automatically filled in by the interface to the GPS telematics provider. All your driver has to do is select the vehicle and press “Start journey” or “End journey”.

Would you rather talk to a human than fill out a form?

Call us and we will connect you with a consultant.

Transportlogy is our powerful transport management software.

For customers, employees, fleet, order, invoice, marketing, logistics, forwarding and shipping.

© Copyright 2018 – 2023 Transportlogy & Kodlogy Technologies GmbH. All Right Reserved.

Design & Development by Kodlogy Technologies GmbH

Transportlogy is our powerful transport management software.

For customers, employees, fleet, order, invoice, marketing, logistics, forwarding and shipping.

© Copyright 2018 – 2023 Transportlogy & Kodlogy Technologies GmbH. All Right Reserved.

Design & Development by Kodlogy Technologies GmbH